ICAI Exam 2024 – Dates, Registration, Exam Form, Syllabus, Admit Card, Exam Pattern

ICAI Exam 2024 – The Institute of Chartered Accountants of India has published its Prospectus on its official website https://www.icai.org/ . The notification highlights the details regarding ICAI Eligibility Criteria, Syllabus, Exam Pattern and much more. ICAI CA Exam is a national level examination held twice a year. Aspirants need to pass the CA Foundation exam to be eligible to appear for CA Intermediate exam. Candidates who qualify CA Intermediate exam can then appear for CA Final exam, which is the last phase of ICAI Examination.

The ICAI (Institute of Chartered Accountants of India) has recently announced the ICAI new exam pattern for CA Final, CA Intermediate, and CA Foundation for attempts from May 2024 onwards. Additionally, the ICAI new exam pattern for May 2024 introduces a complete transformation in the CA exam pattern, as it lowers the number of exams from 8 to 6 for both CA Intermediate and CA Final levels. In addition, it features multiple-choice questions (MCQs) across all CA Inter subjects and CA Final subjects.

Candidates may refer to the table below to know the process in the new scheme vs the old scheme.

| 1. Registration for Foundation / Appear for 10+2: Students can register for the CA Foundation course after completing Class 10 examinations or its equivalent.

2. Appear for Foundation Examination: After a study period of 4 months, candidates can appear for the CA Foundation examination. 3. Study for Intermediate Examination: Upon clearing the Foundation level, students can begin preparing for the CA Intermediate examination, which typically requires 8 months of study. 4. Articleship: After passing the Intermediate exam, students must undergo a 3-year articleship period, during which they gain practical experience under the guidance of a practicing Chartered Accountant. 5. Study for Final Examination: After completing the articleship, candidates can study for the CA Final examination. 6. Total Period to Become ICAI Member: The entire process to become a member of the Institute of Chartered Accountants of India (ICAI) takes approximately 48 months. |

1. Registration for Foundation / Appear for 10+2: Similar to the current scheme, students can register for the CA Foundation course after completing Class 10 examinations.

2. Appear for Foundation Examination: After a study period of 4 months, students can take the CA Foundation examination. 3. Study for Intermediate Examination: Following the Foundation level, candidates can start preparing for the CA Intermediate examination, which now requires an 8-month study period. 4. Articleship: One of the significant changes in the new scheme is the reduced articleship period. After clearing the Intermediate exam, students must undergo a 2-year articleship instead of the previous 3 years. 5. Study for Final Examination: Following the articleship period, students can begin preparing for the CA Final examination, which now requires 6 months of study. 6. Total Period to Become ICAI Member: With the revised duration of articleship and the reduced study period for the Final exam, the total time required to become an ICAI member under the new scheme is approximately 42 months. |

ICAI 2024 Overview

| Features | Details |

| Exam Name | ICAI Exam

|

| Official Website | https://www.icai.org/ |

| Conducting Body | Institute of Chartered Accountants of India |

| ICAI Exam Level | National Level Exam |

| ICAI Exam Frequency | Twice a year |

| ICAI Exam Mode | Online |

| Language | English |

| Eligibility |

|

| ICAI Exam Registration Fee |

|

What is ICAI exam?

Who is a Chartered Accountant?

A designation of Chartered Accountant is worldwide referred to as a professional accountant or Certified Public Accountant (CPA). This qualification opens the door to a vast range of exciting career opportunities in the sphere of business and finance. These professionals can wear a number of hats but the specialization and the CA subjects they choose determines under which umbrella they will work. There are typically 4 areas in which professional accountants serve:

- Taxation

- Applied Finance

- Financial Accounting and Reporting

- Management Accounting

To become a CA (Chartered Accountant), follow this step-by-step guide:

- Register for the CA Foundation Exams.

- Register and successfully pass the CA Intermediate Exam

- Complete the CA Articleship Training of 3 Years.

- Successfully pass both groups of the CA Final Exams.

- Apply for the ICAI Membership.

ICAI exam, also known as the CA exam, is conducted by the Institute of Chartered Accountants of India (ICAI) for aspirants of the Chartered Accountancy profession in India. As per the University Grants Commission (UGC), CA qualification is treated equivalent to a postgraduate degree. The exam is conducted at three different levels as per the CA courses. For being certified as a Chartered Accountant, candidates have to clear all the course levels. There are three levels in the CA course. Given below are the CA courses in order of first to third:

- CA Foundation course examination

- CA Intermediate examination

- CA Final examination

What to do after completing the CA final course?

The different career opportunities available after successfully completing CA final course are as follows:

- Job Roles: Become a Chartered Accountant, Financial Analyst, Tax Consultant, or Audit Manager.

- CFO Potential: Aim for Chief Financial Officer positions, leading a company’s financial decisions.

- Entrepreneurship: Start your own consulting or advisory firm in finance.

- Global Opportunities: Work internationally with multinational companies or global organizations.

- Further Education: Consider additional qualifications like CFA, MBA, or pursuing legal practice.

- Continuous Learning: Stay updated with industry trends and regulations for a successful career.

ICAI Exam 2024 Important Dates

ICAI will update all the important dates regarding CA Foundation, CA Intermediate and CA Final for the year 2024 on its official website soon. The tentative dates for ICAI Exams have been provided in the table below.

| Course | Last Date for Registration under New Scheme | Exam under New Scheme | Announcement of Results | Criteria |

| ICAI CA Foundation | 1st February, 2024 | June, 2024 | August 2024 | A minimum of 4 months study period from the date of registration is required to be completed in order to be eligible to appear in the Foundation Examination |

| 1st August, 2024 | December, 2024 | February 2024 | ||

| ICAI CA Intermediate | 1st September, 2023 | May, 2024 | July 2024 | A minimum of 8 months study period from the date of registration is required to be completed in order to be eligible to appear in the Intermediate Examination |

| 1st March, 2024 | November 2024 | January 2024 | ||

| ICAI CA Final | 1st January, 2024 | May, 2024 | July 2024 | One can register for CA Final Course anytime after completing CA Intermediate i.e. qualifying both groups. |

| 1st June 2024 | November 2024 | January 2024 |

ICAI 2024 Exam Date

ICAI CA Exams are held twice a year. Recently, ICAI published a new scheme for examination and the first examination under this new scheme will be conducted in 2024. The ICAI CA Exam dates will be published soon on their official website.

| Details | Foundation | Intermediate | Final |

| Commencement of Application | To be Announced | To be Announced | Open throughout year |

| Last date to register with the Board of

studies (BOS) |

To be Announced | To be Announced | To be Announced |

| Availability of exam form | To be Announced | To be Announced | To be Announced |

| Deadline for filling the exam form without late fee | To be Announced | To be Announced | To be Announced |

| Deadline for filling CA exam form with late fee (of Rs. 600) | To be Announced | To be Announced | To be Announced |

| Availability of admit card | Around 15 days before exam | Around 15 days before exam | Around 15 days before exam |

| CA 2024 Exam Date |

|

|

|

| CA Announcement of Result |

|

|

|

ICAI 2024 Application Form

- Candidates need to visit the official website of the ICAI at icai.org.

- After visiting the official website, search for the Application link given on the website.

- Students need to click on the e-service option on the front page of the ICAI website.

- Candidates need to select the student service option from the open list.

- Candidates need to select the entry-level forms in the dropdown list.

- Now fill out the application with all the required details as asked in the form.

- Upload the documents in the prescribed format given by ICAI.

- Application fees can be paid online by debit, credit, or net banking cards.

- After payment, download the payment receipt and the application form.

Note- candidates must note down the application number somewhere, as it can be used anytime.

ICAI 2024 Application Fee

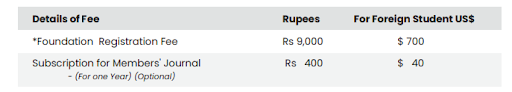

ICAI 2024 CA Foundation Application Fee

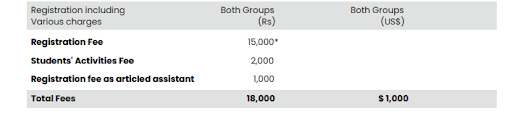

ICAI 2024 CA Intermediate Application Fee

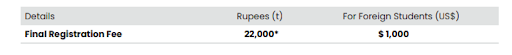

ICAI 2024 CA Final Application Fee

How to Apply ICAI Exam 2024

- Go to ICAI website – https://www.icai.org/

- Click on e-Services > Self Service Portal

- The sign in/ICAI Login form will be opened.

- Login using valid credentials

- Students need to click on the exam functions and then need to select the Exam Enrolment form and click on Foundation Exam form.

- When form loads, students must go through the Important Guideline and Guidance notes on the pop-up screen. Students can save and download the important guidelines. Students need to check on “I have read and understood all the guidelines” check box and after that only student can proceed for form filling.

- Fill up all the details correctly.

- Pay Exam Fee

- Submit

- Students can download the soft copy of exam enrolment form using Application Print tab and keep it with them for future reference.

ICAI 2024 Eligibility Criteria

There is no age bar for appearing in any of three ICAI examinations.

CA Foundation Eligibility

Students need to pass class 12 or equivalent from a recognized board in order to be eligible for the CA Foundation course. Class 10th can also apply for CA Foundation Program, however their candidature will be provisional till they complete their 12th Class.

CA Intermediate Eligibility

Students must clear CA Foundation Examination.

OR

Candidates who have completed graduation or post-graduation in any stream from a recognized institute of India.

CA Final Eligibility

Students must clear CA Intermediate.

ICAI 2024 Syllabus and Exam Pattern

The CA course structure is prepared by the Institute of Chartered Accountants of India (ICAI) and is divided into three levels –

- CA Foundation

- CA Intermediate and

- CA Final

Candidates have to clear the three levels one by one to be certified as a Chartered Accountant.

ICAI CA FOUNDATION Syllabus and Maximum Marks

| Papers | Subject | Marks |

|---|---|---|

| Paper I | Principles And Practice Of Accounting | 100 Marks |

| Paper II | Business Laws And Business Correspondence Section

A: Business Laws Section- 60 B: Business Correspondence And Reporting-40 |

100 Marks |

| Paper III | Business Mathematics, Logical Reasoning, And Statistics Section

A: Business Mathematics Section- 40 B: Logical Reasoning Section- 20 C: Statistics – 40 |

100 Marks |

| Paper IV | Business Economics, Business and Commercial Knowledge Section

A: Business Economics Section – 60 B: Business and Commercial Knowledge-40 |

100 Marks |

ICAI CA Intermediate Syllabus and Maximum Marks

| CA Intermediate | Marks | |

| Group 1 | ||

| Paper 1 | Advanced Accounting | 100 Marks |

| Paper 2 | Corporate Laws | 100 Marks |

| Paper 3 | Taxation

Income Tax Law – 50 Goods and Services Tax -50 |

100 Marks |

| Group 2 | ||

| Paper 4 | Cost and Management Accounting | 100 Marks |

| Paper 5 | Auditing and Code of Ethics | 100 Marks |

| Paper 6A | Financial Management | 50 Marks |

| Paper 6B | Strategic Management | 50 Marks |

CA FINAL Syllabus and Maximum Marks

| CA Final | Marks | |

| First Group Papers | ||

| Paper 1 | Financial Reporting | 100 Marks |

| Paper 2 | Advanced Financial Management | 100 Marks |

| Paper 3 | Advanced Auditing & Professional Ethics | 100 Marks |

| Second Group Papers | ||

| Paper 4 | Direct Tax Laws and International Taxation | 100 Marks |

| Paper 5 | Indirect Tax Laws | 100 Marks |

| Paper 6 | Integrated Business Solutions (Multi-disciplinary case

study with Strategic Management) |

100 Marks |

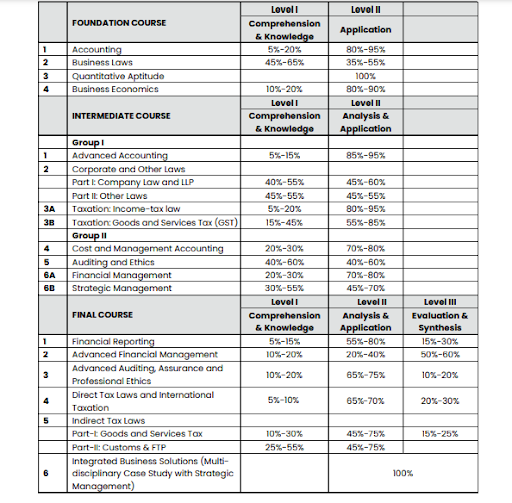

Marking Scheme of CA Foundation, Intermediate and Final is given below.

ICAI 2024 Preparation Tips

- Study ICAI CA Syllabus: Begin your preparation by thoroughly understanding the CA syllabus. This will help you to focus on the relevant topics and allocate your study time efficiently.

- Refer to ICAI CA Study Material: The ICAI Study Material is a comprehensive resource designed specifically for CA Foundation, CA Intermediate, and CA Final exams. It is recommended to refer to it while studying the various subjects.

- ICAI CA Practice Previous Year Question Papers: Practicing CA previous year question papers and answering them in a format similar to the suggested answers will help you develop the skills to present your answers as per ICAI’s expectations. This practice enhances your chances of scoring higher marks.

- Take CA Mock Test Papers: Attempting mock test papers regularly will give you a real-time exam experience and help you identify your strengths and weaknesses. It also helps in improving time management skills and boosting confidence.

- At last, review Test Papers: ICAI Revision Test Papers are designed to assess your understanding of the concepts and topics. Reviewing these papers will allow you to gauge your progress and focus on areas that need more attention.

ICAI 2024 Admit Card

The important information about CA foundation exam admit card is as follows:

- CA foundation exam Admit card is issued about 15 days before the exam date.

- The admit card is published on the official website.

- The candidates must keep a copy of the admit card after downloading.

- Candidates must check the admit card for the details’ accuracy.

- Candidates must follow the instructions on the admit card

- The admit card is required for verification and entry to the exam hall.

ICAI 2024 Answer Key

The Institute of Chartered Accountants of India (ICAI) will release CA Answer Key for all three exams within one month of successful completion of respective examinations. With the help of the response sheet and answer key, candidates can calculate the rough score they secured in the examination.

Step 1: Candidates must visit the official website to download CA Answer Key

Step 2: Click on the ‘Candidate Response Sheet/Answer Key’ link.

Step 3: The screen will display the sheet.

Step 4: Candidates have to download the sheet and take the printout of the same.

Step 5: Match the response sheet with the CA exam Answer key.

Step 6: Calculate the marks using the response sheet, and answer key along the question paper.

ICAI 2024 Result

Step To Download CA Result Online

Step 1: Visit the official website of ICAI at https://www.icai.org/

Step 2: Look for the ‘CA Foundation Result’ link and click on it.

Step 3: Enter your registration number/roll number.

Step 4: Click on the ‘Submit’ button.

Step 5: Download and print the result for future reference.

ICAI Exam 2024 FAQs

Q. When will the CA Final and Intermediate exams for November 2023 be held?

Ans. The CA Final exams for November 2023 will be conducted from November 2 to 17, while the CA Intermediate exams will be held from November 1 to 16.

Q. Why is the CA Foundation Exam important?

Ans: CA Foundation exam is important for becoming a Chartered Accountant in India. However, this is the screening stage out of the three stages. Candidates need to qualify for it in order to be eligible for the CA Intermediate exam.

Q. Is a calculator allowed in the CA Foundation Exam?

Ans: Yes, ICAI allows the use of a calculator in the CA Foundation Exam. However, the calculator should be battery-operated.

Q. What are the qualifying criteria for the CA Foundation Exam?

Ans: The qualifying criteria for the CA Foundation Exam is that candidates need to score at least 40% in each subject. The students appearing for the exam must secure an aggregate of at least 50% marks in the exam.

Conclusion

The ICAI is the largest professional body of Chartered Accountants in the world, with a strong tradition of service to the Indian economy in public interest.It conducts exam twice a year which is an entry-level exam for aspirants who wish to get into the field of Chartered Accountancy. In order to become a Chartered Accountant (CA), aspirants need to clear the CA Foundation exam as it is the first stage after which the Intermediate and Final stages will be conducted. All three stages should be clear in order to become a CA.